The Value of Choosing a Community Bank

Why Regent Bank?

When it comes to banking, bigger isn’t always better. While large corporate banks may have nationwide reach, community banks like Regent Bank offer something even more valuable—personalized service, local investment, and a true commitment to helping individuals, businesses, and non-profits thrive. Here’s what sets us apart:

1. Banking with Relationships, Not Just Transactions

At Regent Bank, you’re more than just an account number. Our team takes the time to know you by name, understand your financial goals, and provide personalized solutions. A study by the Independent Community Bankers of America (ICBA) found that 79% of small businesses prioritize relationships with their community bank over lower rates. Trust and personal service make a difference.

2. Keeping Your Money Local

When you bank with Regent Bank, your money stays in the community—helping local businesses grow, funding home loans, and supporting community projects.

Community banks provide nearly 60% of all small business loans and over 80% of agricultural loans in the U.S. Unlike big banks, we focus on strengthening local businesses and non-profits. That’s why we offer no-fee non-profit accounts—allowing mission-driven organizations to focus on their work, not banking fees.

Community banks provide nearly 60% of all small business loans and over 80% of agricultural loans in the U.S.

-Independent Community Bankers of America (ICBA)

3. Decisions Made with You in Mind

At big banks, loan approvals and policies are decided by corporate offices far from the communities they serve. At Regent Bank, we make decisions locally, considering more than just numbers—we take the time to understand your business, your goals, and your impact.

4. More Than Banking—A Commitment to Education & Leadership

We believe that success starts with knowledge. That’s why we offer free educational events to empower business and community leaders, including:

- Faith in Business – A monthly event on faith-based leadership. (See upcoming events here.)

- Non-Profit Leadership Series – Helping non-profits grow and connect. (See upcoming events here.)

- Executive Luncheon Series – Networking and learning for top executives. (See upcoming events here.)

Unlike big banks, we invest in your success beyond just financial services.

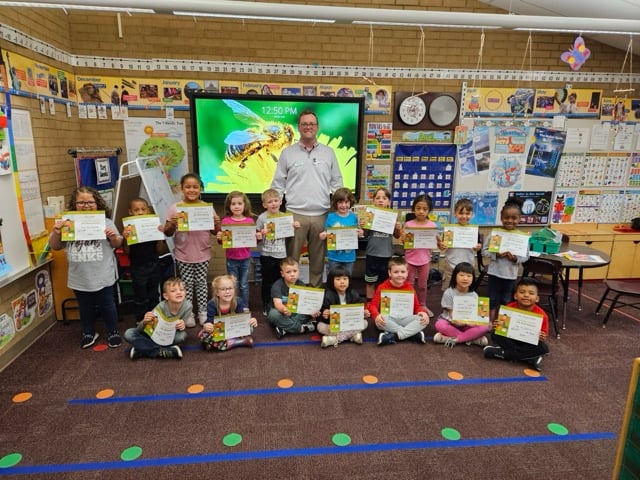

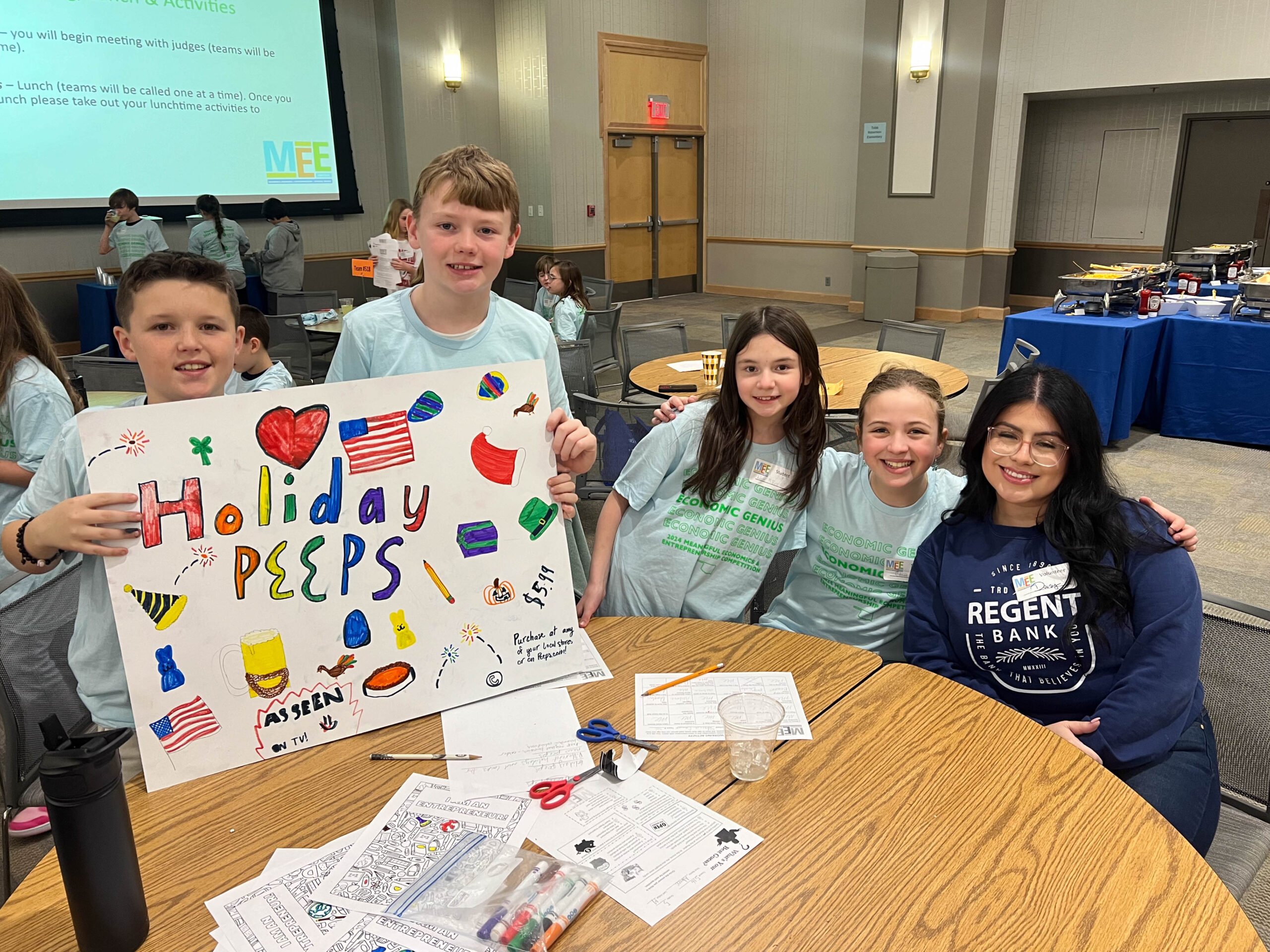

5. Actively Giving Back to Our Community

Regent Bank is deeply involved in community initiatives such as Junior Achievement of Oklahoma and Tulsa Area United Way, giving our time and resources to help others thrive.

Our team volunteers regularly because we believe strong communities make for strong businesses.

6. Fewer Fees, Better Service

Big banks rely on hidden fees. At Regent Bank, we focus on exceptional service with fewer fees so you can keep more of your money. Our no-fee non-profit accounts and flexible small business services make banking simple, affordable, and personal.

When you choose Regent Bank, you’re choosing more than just a bank—you’re choosing a partner that’s invested in your success. Whether you’re a business owner, a non-profit leader, or looking for a bank that truly cares, we’re here for you.

Visit us today and discover the power of community banking.