3 Quick Tips to Protect your Business Against Fraud

Fraud prevention is a critical aspect of safeguarding your business’s financial well-being. Here are three simple yet effective tips to help you protect your business from potential fraud:

1. Enable Transaction Alerts

Stay informed by enabling transaction alerts, especially for when funds are leaving your account. These real-time notifications can help you quickly spot any unauthorized or suspicious activity and take immediate action.

Here is how you can turn on transaction alerts in the Regent Mobile app:

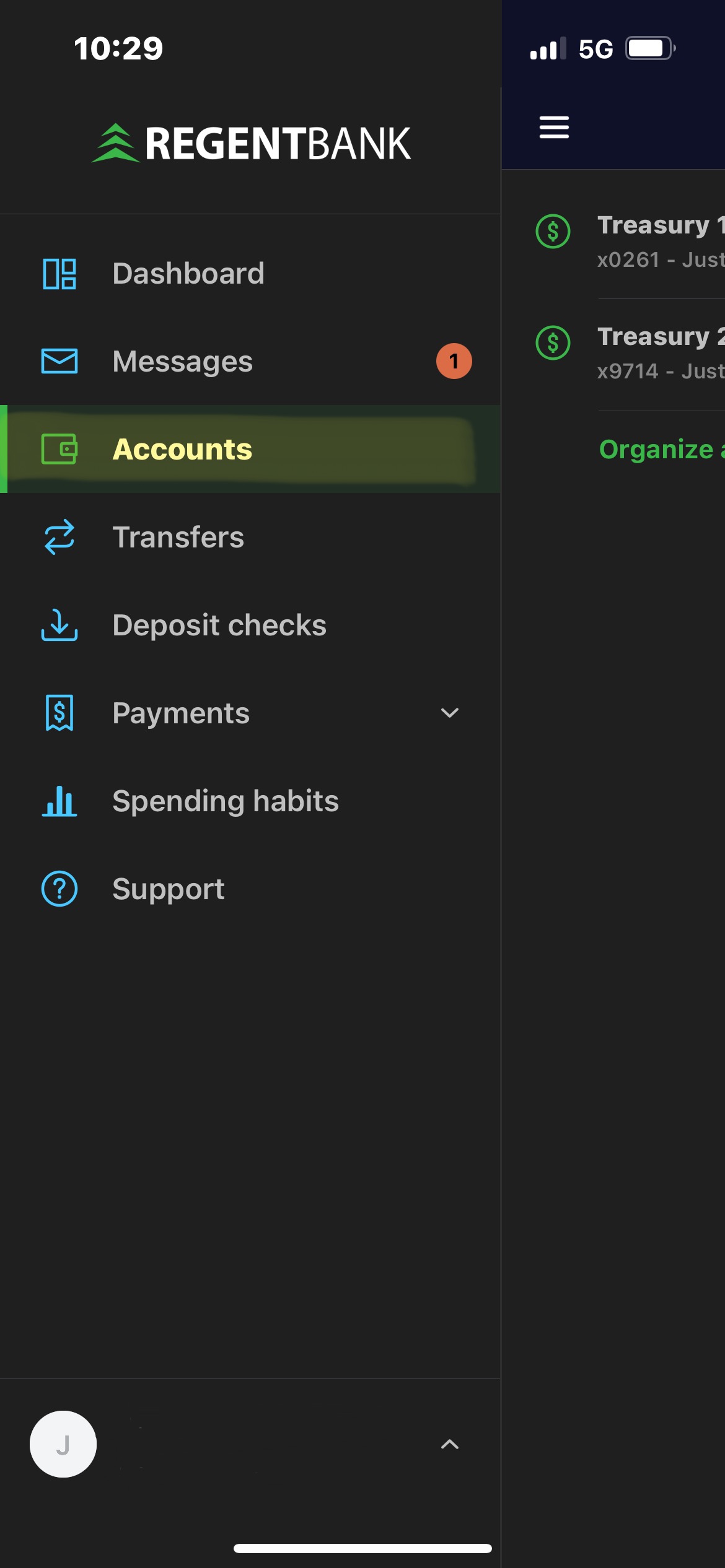

On the navigation menu, click “Accounts.” Select the account that you would like to add the alerts.

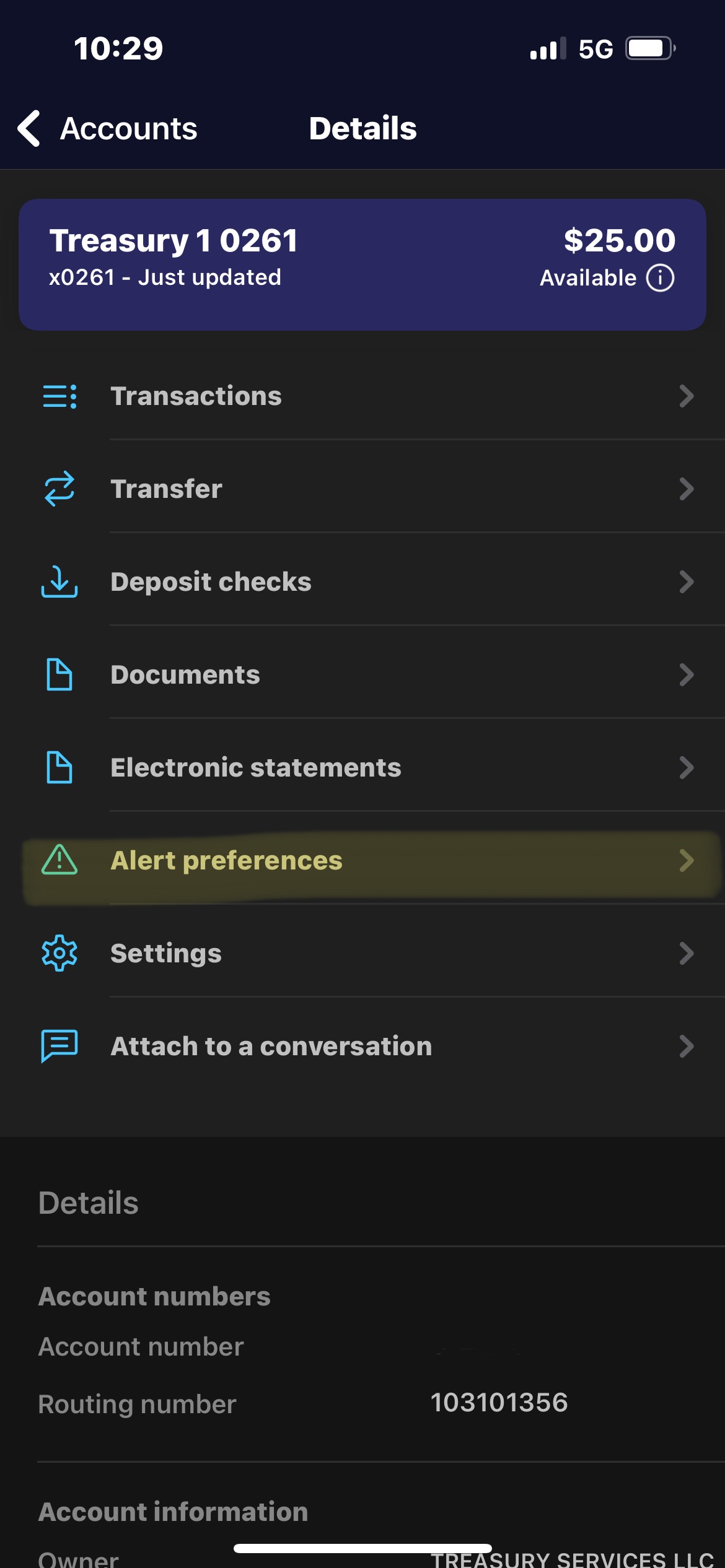

Select “Alert Preferences.”

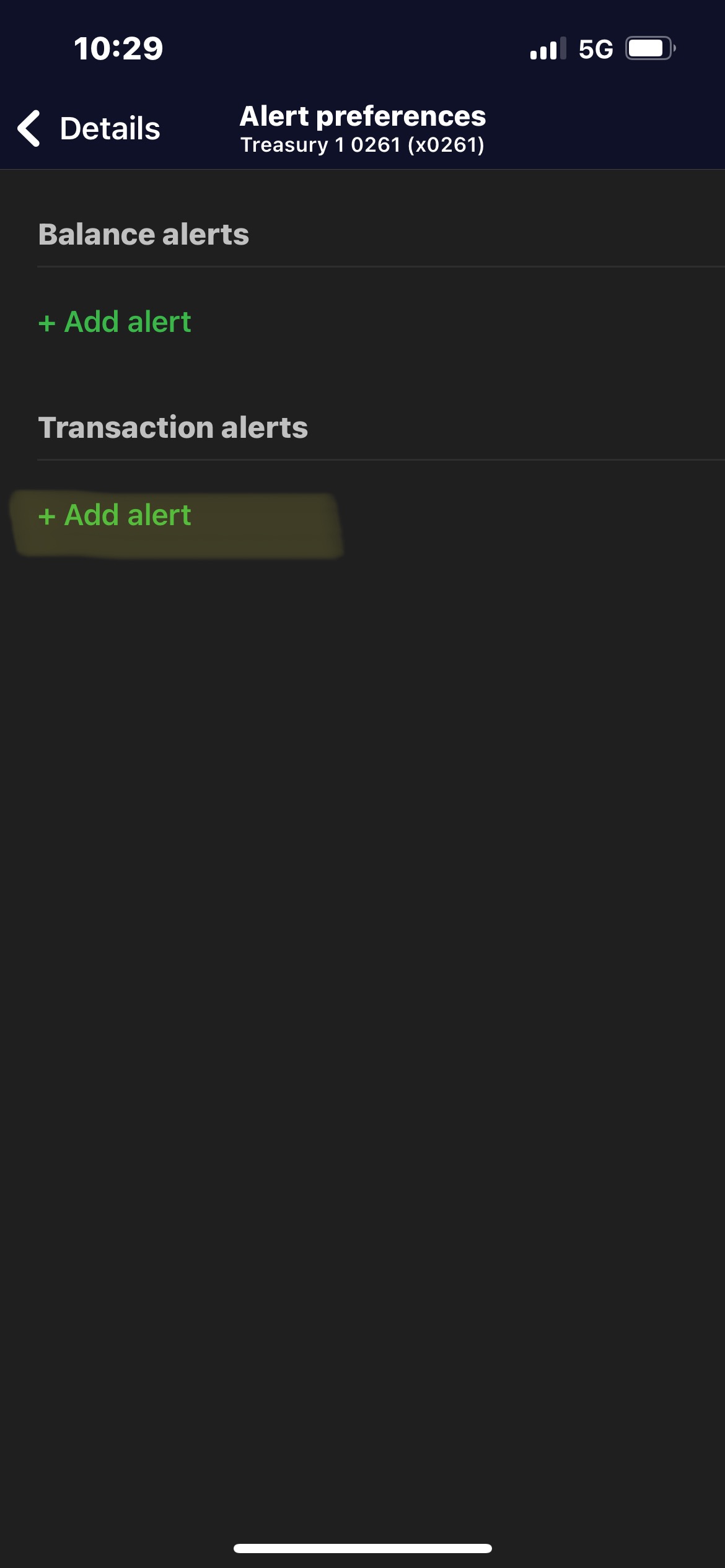

Select “Add Alert” under the transaction alert tab. You can select the minimum amount and the method that you wish to be notified (email, text, or in-app message.)

2. Utilize Dual Control Processing

If your business frequently processes wire transfers or ACH transactions, consider implementing dual control processing. This means requiring two separate approvals before a transaction is completed, adding an extra layer of security to your payment processes.

You can enable dual control by contacting our Treasury Services division. They will be happy to set it up for you.

3. Leverage ACH Positive Pay and Check Positive Pay

Take advantage of fraud prevention tools like ACH positive pay and check positive pay. These tools allow you to review and approve transactions before they clear, ensuring only authorized payments are processed.

By incorporating these measures, you can significantly reduce the risk of fraud and keep your business accounts secure. Proactively protecting your finances is a smart investment in the longevity and success of your business.